- Analytik

- Grundstimmung des Marktes

US dollar bullish bets fall on disappointing US economy performance

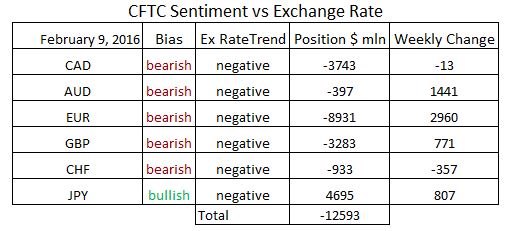

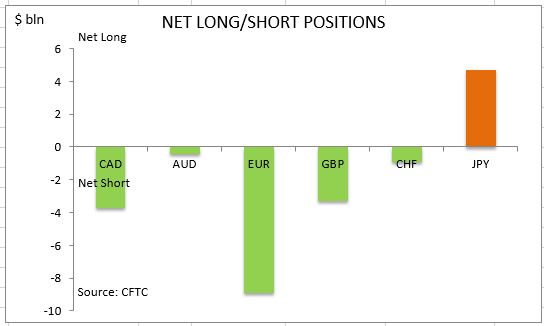

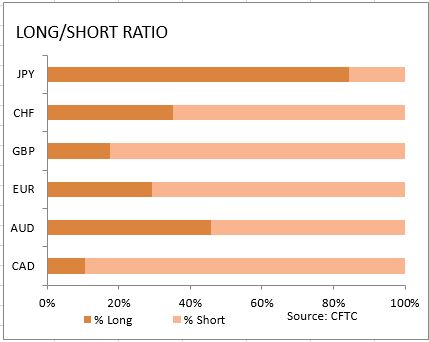

US dollar net long position fell to $12.6 billion from $18.2 billion against the major currencies in the previous week, as the report of the Commodity Futures Trading Commission (CFTC) covering data up to February 9 shows. Economic reports during the week confirmed that the US economic growth is slowing. The services sector growth was weaker than expected with ISM Non-Manufacturing PMI falling to 53.5 in January from 55.8 in December. Manufacturing activity contraction was indicated by a further fall in Factory Orders in December which exceeded the decline in the previous month: less volatile factory orders excluding transportation fell 0.8% on month compared with 0.7% reduction in November. The jobs report indicated the growth in nonfarm employment also slowed as anticipated, with private payrolls rising by 158 thousand in January instead of expected 183 thousand jobs. On the positive side unemployment fell to 4.9% from 5% and average hourly earnings rose 0.5% in January compared with no change in December. Improving labor market continues to serve as one of the justifications for policy makers’ rising inflationary expectations and shift to contractionary monetary policy. However, the slowing US economic growth, continued slump in commodity prices and turmoil in global stocks markets make it less likely that the Federal Reserve will implement the 100 basis point rate hike announced in December policy statement. Investors cut the bullish bets on US dollar as market participants revised downward the likelihood of further interest rate hikes. As is evident from the Sentiment table, sentiment improved for all major currencies except for the Swiss franc and Canadian dollar. And the yen continues to remain the only major currency held net long against the US dollar.

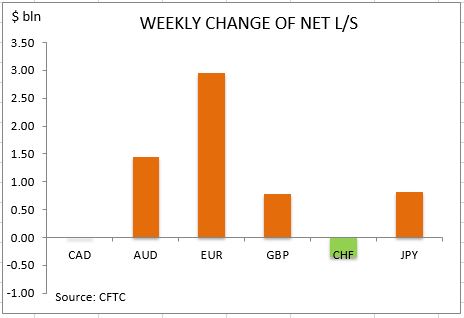

The bearish euro sentiment improved substantially as net short bets narrowed by $2.9bn to $8.9bn. However euro’s share rose to over 70% of long US dollar position. The euro net short position fell as investors increased long positions and covered shorts by 18595 and 5164 contracts respectively. The bullish Japanese yen sentiment intensified on the back of heightened haven demand as the slump in global equities continued. The net long bets in Japanese yen rose by $0.8bn to $4.6bn. Investors reduced the gross longs by 6297 contracts and reduced gross shorts by 12284. Sentiment improved considerably for the British Pound with the net short position narrowing by $0.7bn to $3.2bn. Investors cut both the gross longs and gross shorts.

The bearish sentiment remained essentially unchanged for the Canadian dollar with the net short position widening by $13 million to $3.7bn. Net short bets in Canadian dollar became the second biggest after bearish bets in euro. Investors cut both the gross longs and gross shorts. The sentiment toward the Australian dollar improved dramatically with net short bets narrowing by $1.4bn to $0.39 bn. Investors increased the gross longs and cut the gross shorts. The sentiment continued to deteriorate for the Swiss franc with net short bets rising by $0.3bn to of $0.9bn. Investors cut both the gross longs and gross shorts.

New Exclusive Analytical Tool

Any date range - from 1 day to 1 year

Any Trading Group - Forex, Stocks, Indices, etc.

Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.

Letzte Stimmungen

- 18Mär2021Weekly Top Gainers/Losers: Canadian dollar and Japanese yen

Over the past 7 days, prices for oil, non-ferrous metals and other mineral raw materials decreased but still remained high. As a result, the currencies of the commodity countries strengthened: the Canadian dollar, the Australian and New Zealand dollars, the Mexican peso, and the South African rand. The...

- 10Mär2021Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the Canadian dollar, strengthened. The New Zealand dollar weakened after the announcement of negative economic indicators: ANZ Business Confidence and...

- 4Mär2021Weekly Top Gainers/Losers: American dollar and South African rand

Over the past 7 days, oil quotes continued to grow. Precious metals, including gold, fell in price. Against this background, the shares of oil companies increased, the Russian ruble strengthened, the Australian and New Zealand dollars, as well as the South African rand, weakened. The US dollar strengthened...